Elev8+ Sweep Reversal Playbook: Trading The Trap & Fade

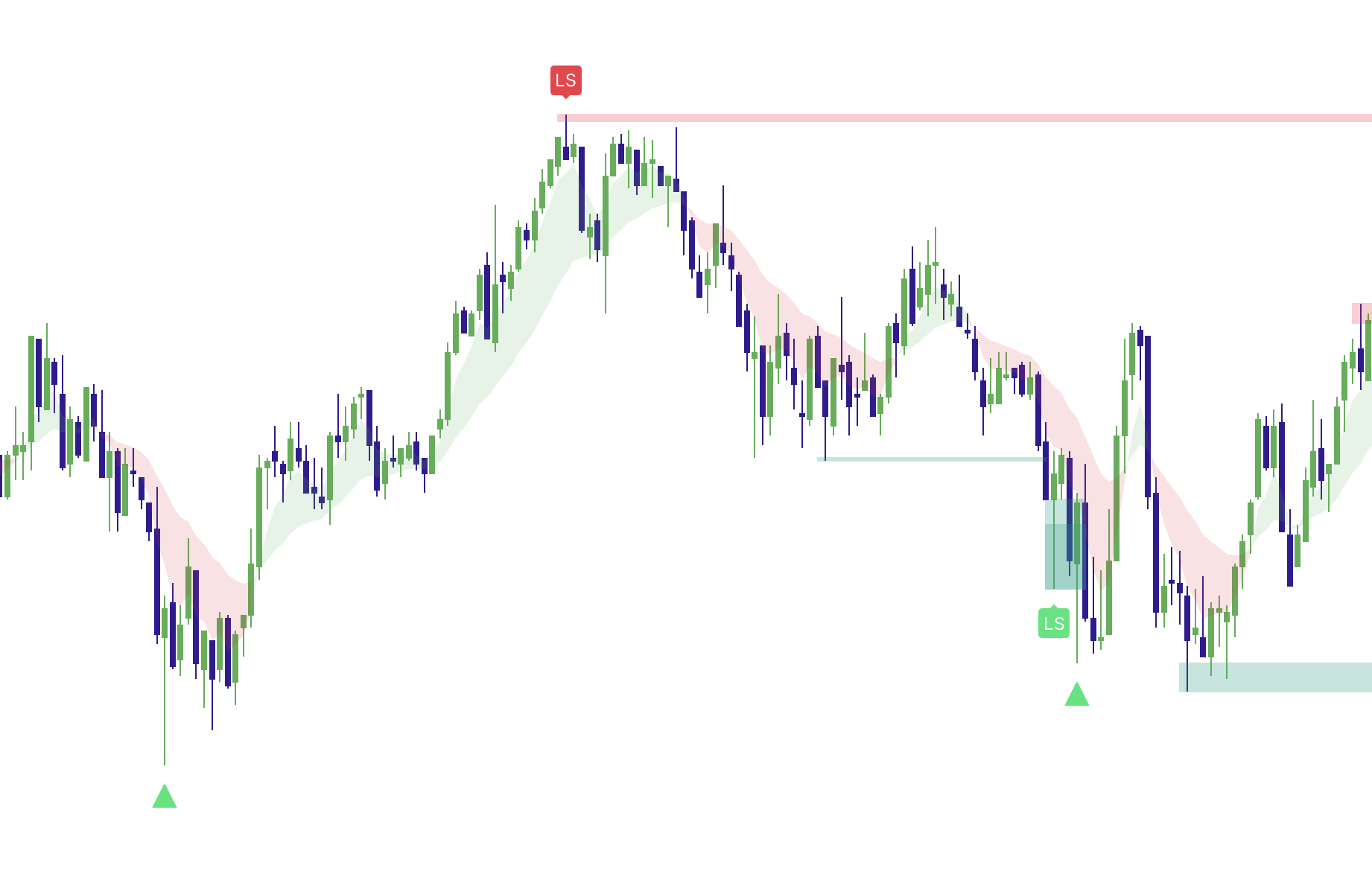

One of the core advantages of Elev8+ is the ability to trade right after a liquidity sweep has already completed with non-repainting signals. Instead of guessing tops or bottoms, you wait for price to run a key level, harvest liquidity, reject back inside, and confirm with a triangle reversal or LS premium label. This keeps your execution aligned with institutional behavior and your stop loss tight, rather than trading emotional breakout noise and "feelings" with no plan.

Framework mindset: The Trap & Fade

The market's goal is to trap late breakout buyers/sellers and then fade the move back into the range. Elev8+ is designed to help you identify the trap and participate only once rejection is confirmed and risk is calculated.

What Makes a Qualified Sweep? (The 4 Criteria)

A qualified liquidity sweep typically has four clean characteristics. You need all four to confirm the rejection:

- Location: Price runs above a prior high or below a prior low (ideally a major Elev8+ sweep level).

- Speed: Stops trigger and participation expands at the extreme.

- Rejection Wick: A visible wick forms outside structure.

- The Close: The candle closes back inside the prior range (this is the most critical confirmation).

Context matters. The best sweeps are often printed at major magnets such as: Prior Day High/Low, Session highs/lows, or Weekly/Monthly extremes.

Step 1: Define Your Sweep Levels (The "Magnets")

Turn on Sweep Levels+ or Market Map and select only the levels you plan to monitor for the session. Focus on Tier 1 (PDH/PDL) and Tier 2 (Session H/L) levels first.

- Prioritize: Prior Day High/Low (PDH/PDL).

- Monitor: Session highs and lows (Asia, London, NY).

- Minimize: You do not need every level active. Fewer, clearer lines are better.

- Market Map: Confirms the sweep is occurring at a true structure magnet (not a random pivot).

- Market Extremes: Confirms you’re near a boundary where sweep reversals are more realistic (vs mid-range chop).

- Momentum Gaps: Maps clean rotation objectives on the way to VWAP/mid-range (gap fills / inefficiencies).

Step 2: Wait for Price to Run the Level (Observe the Hunt)

Do not trade during the run. A true sweep often arrives with speed, emotion, and one-directional pressure into the level. This move is the liquidity harvest.

- No Trade Yet: The setup is not confirmed; you are only observing the hunt.

- Observe Wick Intent: Look for a candle to aggressively tag the level and pierce it.

Step 3: Confirm the Rejection (Wait for the Close)

A sweep is incomplete until rejection is confirmed by the candle close.

- Confirmation Check: Did the candle close back inside the range? (If it closed strongly outside, it's a breakout.)

- Signal Validation: Did a Triangle signal (raw sweep) or LS label (premium sweep) print?

Entry Trigger: Your entry is only taken after the confirmation candle closes and the signal prints.

Step 4: Execute the Trade (Entry, Stop, & Targets)

Sweep reversals offer a precise and logical risk model.

- Entry: Enter on the open of the candle following the confirmed sweep and signal candle.

- Stop Loss: Place strictly beyond the sweep wick extreme. If the stop is hit, the rejection thesis is invalidated.

- Target 1 (Mean Reversion): Take partial profits at VWAP or the range midpoint.

- Target 2 (Rotation): Hold runners for the next major Elev8+ level on the opposite side.

Step 5: When to Stand Aside (Skip the Noise)

Skip the trade when the sweep lacks institutional quality or structural definition:

- No Level Present: The sweep happens in the middle of nowhere.

- Choppy Rejection: The rejection wick is small or the close is weak/ambiguous.

- Thin Liquidity: The move has no volume rather than institutionally absorbed.

Optional Advanced Confirmation

Elev8+ is powerful on its own, but experienced traders sometimes layer:

- Order Flow: Look for CVD divergence (price makes a new high, CVD does not) or Bookmap absorption at the extreme.

- Session Timing: Prioritize sweeps that happen within 30 minutes of a major session open (London or NY).

Summary: The Sweep Playbook Checklist ✅

Quick checklist

- Identify a major sweep level (PDH/PDL or Session High/Low).

- Allow price to run the level aggressively.

- Confirm rejection with wick + triangle/LS signal on lower timeframe (1m, 2m, 5m, 15m).

- Set Stop beyond the wick extreme.

- Target VWAP or the range midpoint first and hold for opposite liquidity level if move is strong.

This playbook helps Elev8+ users shift away from emotional breakout trading and into structured, asymmetric sweep reversals with clear invalidation, defined targets, and repeatable execution.