LS vs Triangle: Understanding Elev8+ Sweep Signal Quality

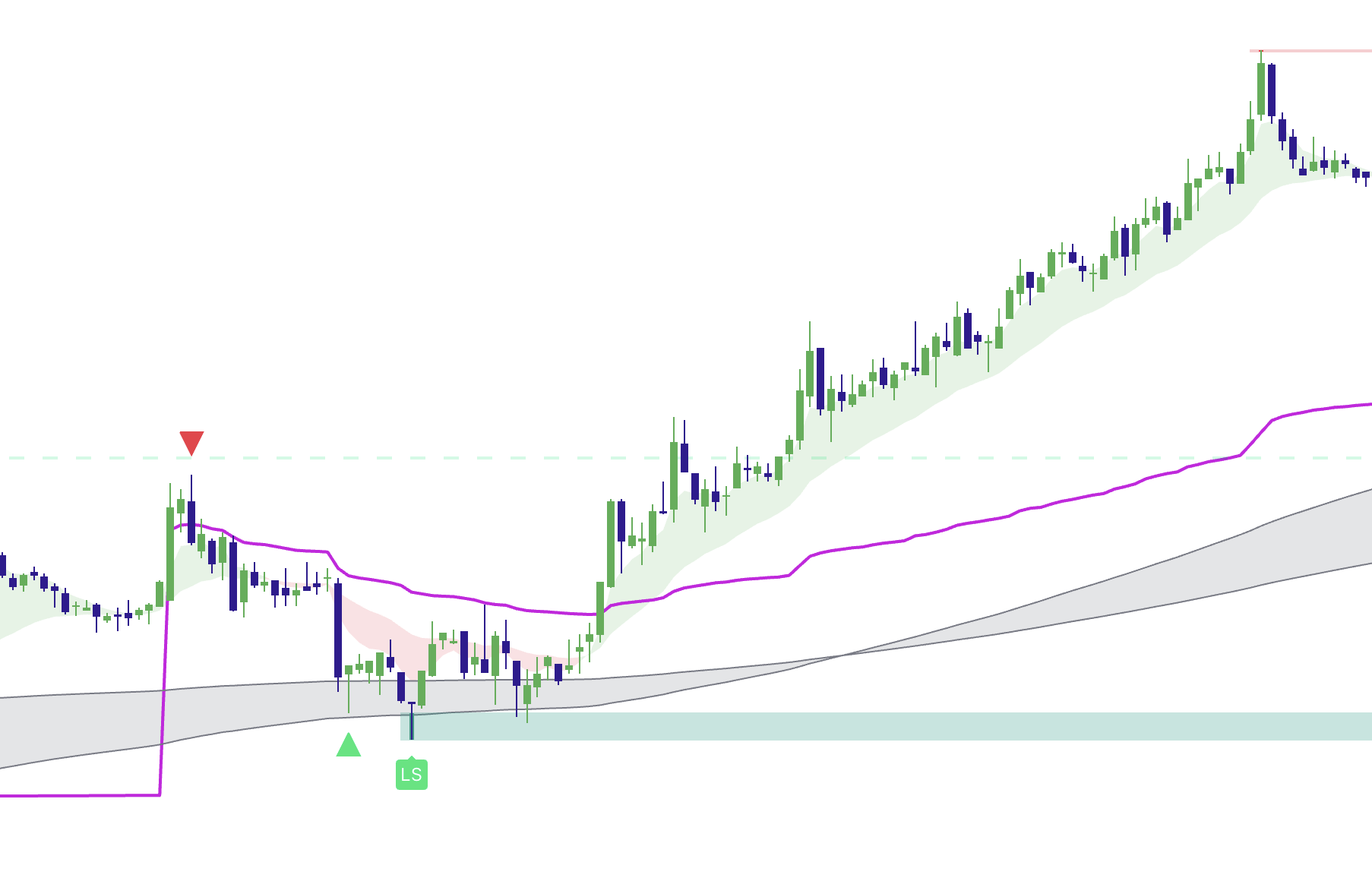

The Elev8+ indicator prints two primary reversal confirmations: triangle signals and LS premium sweep labels. Both represent valid liquidity-based reversal environments, but they differ in frequency, confirmation depth, and how selectively you may want to trade them.

The "Metal Detector" Analogy

Think of Triangles like a standard metal detector. It beeps whenever it finds metal, which is great, but sometimes it's just a bottle cap.

Think of LS Labels like a sophisticated gold scanner. It beeps far less often, but when it does, the probability of finding value is significantly higher.

The "Day 1" Protocol for New Users

If you just installed Elev8+, you might be tempted to take every signal. Don't. Follow this protocol for your first week to protect your capital while you learn:

- Ignore Triangles completely. (Mentally filter them out).

- Only trade LS Labels that appear at major levels (PDH/PDL).

- Why? This forces you to be patient and only see the "A+" setups.

Triangle Signals (Raw Sweep Reversals)

Triangle signals appear when price displays the essential sweep and rejection behavior. At a high level, this typically means a candle:

- Pierces a meaningful liquidity area

- Shows a clear rejection back toward prior structure

- Aligns with core volatility and reversal criteria built into Elev8+

Triangles are designed to identify the most common stop-hunt and snapback patterns without demanding the deeper premium filters reserved for LS.

Where triangles are strongest

- Scalping around clear session or prior-day structure

- Fading extremes when the level context is obvious

- Capturing faster mean reversion cycles with disciplined trade selection

Key limitations to respect

- Triangles can still appear during choppy or mixed intraday conditions

- They benefit from added context such as major levels, session timing, or clean rejection

- They require more trader discretion when liquidity is thin

LS Labels (Premium Sweep Confirmations)

LS labels require a deeper and more selective validation layer. While the exact internal logic is proprietary, the intent is consistent: LS is designed to highlight higher-quality sweep reversals occurring in stronger structural and volatility environments.

At a high level, LS is more likely to appear when a sweep is supported by:

- Clear rejection structure at a meaningful liquidity magnet

- A stronger volatility and quality filter aligned with premium setups

- Higher-confidence context often seen around major session or higher timeframe levels

Where LS shines

- Major sweep levels such as prior day, session, or higher timeframe extremes

- Institutional participation windows (especially around session opens)

- Setups where you want a more selective entry filter before committing size

Trade-off to understand

- LS is less frequent by design (you may only see 1-2 per session).

- Some profitable raw sweeps may not receive an LS label.

- The objective is not more signals, but cleaner signals.

Accuracy vs Frequency: Choosing the Right Tool

Most Elev8 users notice the same practical relationship over time:

- Triangles offer more opportunity and require stronger context filtering.

- LS offers more selectivity and is often easier to size with confidence.

You do not need to “pick one forever.” The most consistent traders use triangles to stay aware of sweep behavior and LS to prioritize their highest conviction entries.

Reality Check: Can LS Signals Fail?

Yes. No indicator is 100%. An LS Signal is a high-probability setup, not a guarantee.

When LS Fails

If an LS Signal prints against a massive, runaway trend day (e.g., during a Fed speech or major earnings), it can still fail. Always use a stop loss beyond the sweep candle. If the candle is engulfed, the trade is invalid, regardless of the label.

When LS Should Be Your Primary Signal

LS confirmations are especially valuable when:

- Price is interacting with a clearly defined major level

- The sweep prints with clean rejection and visible intent

- You want a more selective filter before increasing risk or size

- Session timing suggests stronger participation and stop clustering

Risk and Stop-Loss Behavior

Both signal types follow the same foundational risk model: your invalidation is the sweep extreme.

- Stops are typically placed beyond the wick that harvested liquidity.

- LS setups may justify slightly higher confidence positioning.

- Triangle setups often benefit from smaller size unless additional confluence is present.

This risk structure is one of the reasons sweep trading can be so asymmetric when you stay selective and disciplined.

Summary

Quick recap

- New Users: Stick to LS Labels only for your first week.

- Triangles = Frequent alerts; need you to verify the level context.

- LS Labels = Rare, high-confidence setups; better for sizing.

- Risk Management: A signal is an opportunity to manage risk, not a promise of profit.

Mastering Elev8+ means understanding how to combine raw detection with premium selectivity. Use triangles to stay connected to the market’s sweep rhythm, and use LS to prioritize the highest-quality opportunities when it counts.