The Elev8 Sweep + VWAP Strategy Breakdown

The Sweep + VWAP reversion is one of the most consistently asymmetric intraday frameworks inside the Elev8 system. This setup is built around a simple institutional sequence: liquidity is harvested at extremes, then inventory unwinds back toward fair value.

The "Rubber Band" Analogy

Think of VWAP as the "anchor" and price as a rubber band. When price stretches too far (the Sweep) and runs out of energy (the Rejection), physics takes over, and it snaps back to the center (VWAP).

Why Sweeps and VWAP Pair So Well

Once liquidity has been harvested at a major high or low, larger participants often unwind inventory and rebalance exposure. That rebalancing is frequently anchored around VWAP.

Institutional traders are often judged on their execution performance relative to VWAP. They are incentivized to buy/sell near this line. This makes VWAP a self-fulfilling prophecy: it is the "fair price" everyone agrees on.

This creates a clean and teachable sequence:

- Sweep exhausts directional liquidity at a known magnet.

- Rejection confirms the breakout was not accepted.

- Rotation pulls price back toward VWAP (Fair Value).

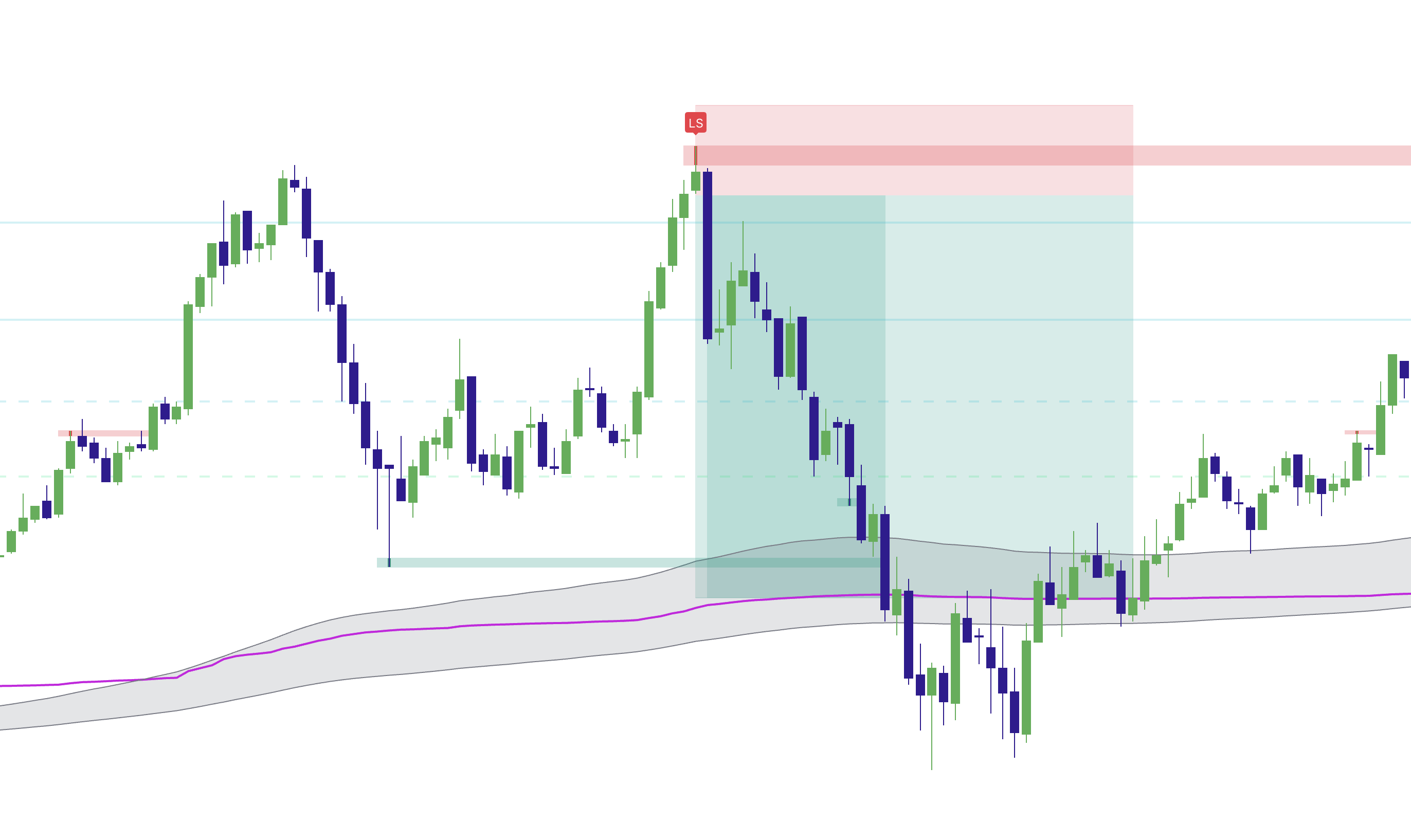

Step 1: Identify a Qualified Sweep (The Stretch)

A qualified sweep is not just any spike beyond a local high/low. Your highest-quality entries usually form when:

- Price runs a major level (PDH/PDL are the strongest rubber bands).

- Momentum pushes emotionally into the extreme.

- A clear wick prints beyond the level.

- The candle closes back inside the prior structure.

Elev8 confirms this behavior using:

- Triangle reversal signals for raw sweep reversals.

- LS labels for more selective, premium-quality sweeps.

Step 2: Place Stop Beyond the Wick Extreme (The Safety)

Sweep reversals offer one of the cleanest risk models in intraday trading because the invalidation point is obvious.

- Shorts: Stop goes above the wick that harvested upside liquidity.

- Longs: Stop goes below the wick that harvested downside liquidity.

Rule of Thumb: If price breaks that wick, the "Rubber Band" has snapped. Get out.

Step 3: Target VWAP First (The Snap Back)

After a qualified sweep, the most natural first objective is mean reversion:

- Target 1: VWAP (The Center Line)

- Target 2: Mid-Range of the session

Crucial Filter: Is VWAP Flat or Angled?

Not all VWAP environments are equal. The shape of the VWAP line tells you the market state.

When VWAP is relatively flat or horizontal, the market is in a "Range/Rotation" state. These are the best conditions for Mean Reversion trades. Price wants to return to the middle.

When VWAP is angled steeply (45 degrees up or down), the market is in a "Trend" state. In a strong trend, price may not return to VWAP quickly. Be very careful fading trends unless the sweep is at a massive timeframe level.

Step 4: Extended Targets

If price reaches VWAP and the rotation remains healthy, you can consider extended objectives:

- The opposite side of the range (e.g., Short at PDH, Target PDL).

- The next major auto-plotted sweep level in the path of the move.

Step 5: Best Timing Windows

Sweep + VWAP reversions are often cleanest during:

- London sweeps that set the tone for later continuation or rotation

- New York Open (9:30 - 10:30 AM EST): The "Initial Balance" often involves a sweep followed by a VWAP test.

- Late-session stop hunts near obvious daily extremes.

When to Skip the Setup

Stand aside when the structure does not support an institutional-quality sweep:

- No major level is present at the extreme.

- Liquidity is thin and the sweep lacks emotional intent.

- VWAP is acting as Support/Resistance: If price touches VWAP and bounces away from it, do not trade against that momentum.

Summary

Quick checklist

- Wait for price to sweep a major liquidity level.

- Check VWAP slope: Is it flat? (Good). Is it steep? (Caution).

- Confirm rejection with an Elev8 triangle or LS.

- Place your stop beyond the wick invalidation point.

- Target VWAP first.

This is a foundational Elev8 framework because it removes prediction from the equation. You are not chasing momentum or guessing reversals. You are trading the natural rotation that often follows a completed liquidity event and letting price gravitate back toward fair value.