Sweep Invalidation Rules: When an Elev8 Sweep Is NOT a Trade

Elev8 sweep reversals are powerful, but they are not meant to be traded blindly. A sweep is only high-quality when level context, structural rejection, and market participation align. This guide is designed to help you invalidate weak sweeps and avoid low-quality setups.

Your core sweep trigger still comes from Elev8+ Pro (levels + triangles/LS), but your invalidation improves when you layer: Market Map to confirm the “real” magnets (HTF levels, session structure, VWAP), Market Extremes to spot trend/range regime boundaries (avoid mid-range noise), and Momentum Gaps to gauge whether price is rotating cleanly or accepting/continuing through imbalance. These tools are optional—use them to filter, not to overcomplicate.

The Traffic Light Check

Before every trade, ask:

RED LIGHT: Is this against a massive trend or strong acceptance? (Stop)

YELLOW LIGHT: Is the wick small, messy, or indecisive? (Caution / Reduce size)

GREEN LIGHT: Is it at a major level with a clean rejection and reclaim? (Go)

Reminder: Triangles are higher-frequency “attention” triggers and can appear in low-quality conditions. LS is more selective—but still requires location + reclaim to be a trade.

Invalidation Rule 1: The “Middle of Nowhere” Sweep (No Level)

A sweep is far less meaningful if price is not attacking a visible liquidity magnet. If a triangle appears in the middle of a range with no level narrative, skip it.

- Prior Day High / Low (Gold Standard)

- Session highs & lows (Silver Standard)

- Weekly or Monthly extremes

Optional confluence: If Market Map is not showing a nearby HTF/session magnet and price is not interacting with a meaningful value area (like VWAP), you’re likely staring at noise, not external liquidity.

Invalidation Rule 2: The “Strong Trend” Sweep (Account Killer)

This is the #1 way traders blow up fading reversals. Do not try to catch a falling knife (or a rocket ship).

Trend Day Warning

If the market has been trending strongly in one direction for 2+ hours without meaningful pullbacks, do not fade the first sweep you see. Strong trends often push through multiple levels before reversing. Wait for a clearer shift in structure (e.g., a break of a prior higher low / lower high) before entering.

Optional confluence: Market Extremes helps identify when you’re fading inside a strong regime versus fading near a true boundary. If price is expanding through the regime with no meaningful rotation, treat early “sweeps” as continuation risk.

- Skip the fade if you see 2+ candle closes outside the swept level and price holds it (level flip).

- If the sweep “reclaim” doesn’t happen quickly, assume continuation risk until proven otherwise.

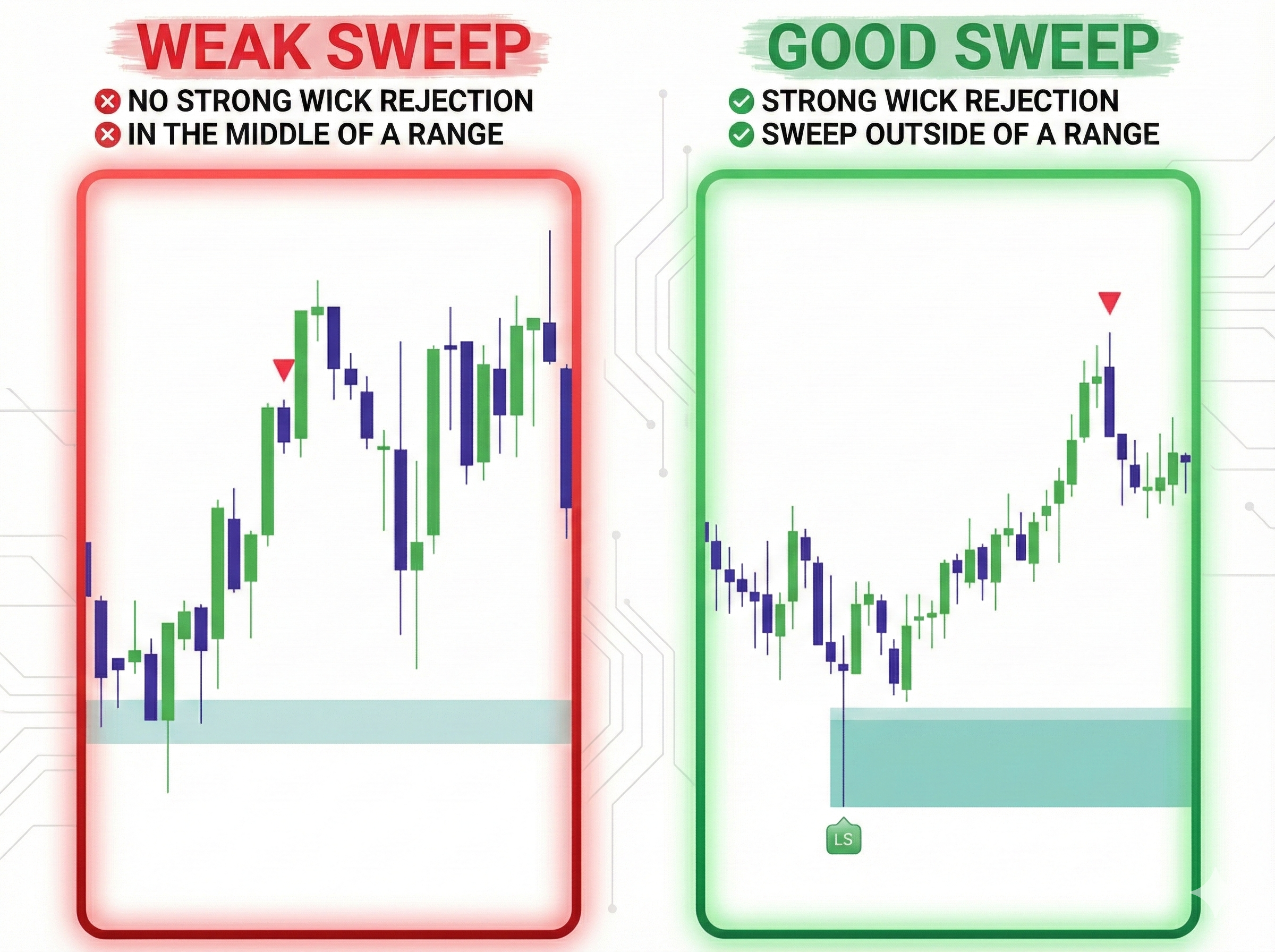

Invalidation Rule 3: Weak or Sloppy Wick Structure

A valid sweep candle should communicate a clear story: price briefly runs the level, meets resistance, and is pushed back with intent.

- Good Wick: Long tail, smaller body, clearly protruding beyond the level.

- Bad Wick: Tiny tail, large body, or a doji that looks indecisive.

Rule of thumb: if you have to “argue” with the candle to make it look like rejection, it’s probably not rejection.

Invalidation Rule 4: Low Volume or Thin Participation

Sweeps that appear during slow or low-participation periods (like the NY Lunch hour, 12pm–1pm EST) often fail. The market has less follow-through, and “rejections” turn into slow chop.

If liquidity feels dead, stand aside.

Invalidation Rule 5: Sweep Without Complete Rejection (Acceptance vs. Rejection)

A reversal-quality sweep is incomplete until the bar shows confirmed rejection behavior. The close matters more than the wick.

- Did price reclaim back inside the level zone?

- Did it hold inside on the next bar (no immediate re-sweep/acceptance)?

- Is the triangle/LS printing at the level, not mid-range?

- Not a Trade: Price pierces the level but the candle body closes outside or directly on the level with no reclaim.

- Requirement: You must see the candle close back inside the prior range. If price holds the level, that’s acceptance, not rejection.

Optional confluence: Momentum Gaps can help here. If price sweeps a level and then continues accepting through imbalance with no reclaim, treat it as continuation behavior—not a reversal.

Invalidation Rule 6: Sweeps Inside Micro Consolidation

Some “sweeps” occur within narrow boxes or small local ranges. These are often just noise.

- Skip sweeps that only run a tiny local high/low inside a tight box (micro liquidity).

- Prefer sweeps that reach into external liquidity (session extremes, PDH/PDL, weekly/monthly) and then reclaim.

Optional confluence: If Market Extremes suggests you’re mid-regime and Market Map is not showing a nearby major magnet, micro sweeps are usually lower quality (chop risk).

When to Size Down or Skip Entirely

If one or more invalidation criteria are present:

- Reduce size (half risk), or

- Skip the trade entirely (preserve mental capital).

The best asymmetric entries tend to occur when these conditions align:

- A major level is present.

- The wick is emotional (long) and clear.

- The candle closes back inside the range.

- It is not fighting strong acceptance / a massive trend day.

Summary

- No major level = Skip.

- Fighting strong acceptance / trend day = Skip (or wait for double confirmation).

- 2+ closes outside = Skip (acceptance / continuation risk).

- Candle closes outside = Skip (it’s a breakout / acceptance).

- Lunch hour / thin participation = Skip.

Final mindset

Trading Elev8 is not about taking more signals. It is about refining your filters until you are consistently trading the sweeps that occur in the right place, with the right rejection.