Elev8+ Indicator: Complete Chart Legend & Visual Guide

The Elev8+ ecosystem is built to make market structure, institutional liquidity behavior, and reversal opportunities easier to read in real time. This page is your complete visual legend for every symbol, line, box, sweep level, and abbreviation you will see on the chart in the flagship Elev8+ Pro Indicator.

New User Tip: Do not try to memorize every abbreviation instantly. Focus on the "Power Hierarchy" section below first.

Recommended "Day 1" Setup (Avoid Clutter)

Elev8+ Pro is powerful, but turning on every feature at once can be overwhelming. We recommend this clean configuration for your first week:

- Signals: Enable Triangles and LS Labels.

- Levels: Enable PDH/PDL and Session Highs/Lows.

- Disable: Bollinger Deviation Zones, Weekly/Monthly levels and 15m Pivots (you can add these later).

Optional: Once this Pro legend feels familiar, you can add more layers for clarity (not clutter): Market Map for structure/levels, Market Extremes for exhaustion zones, or Momentum Gaps for rotation targets and support.

Elev8 Reversal Signals

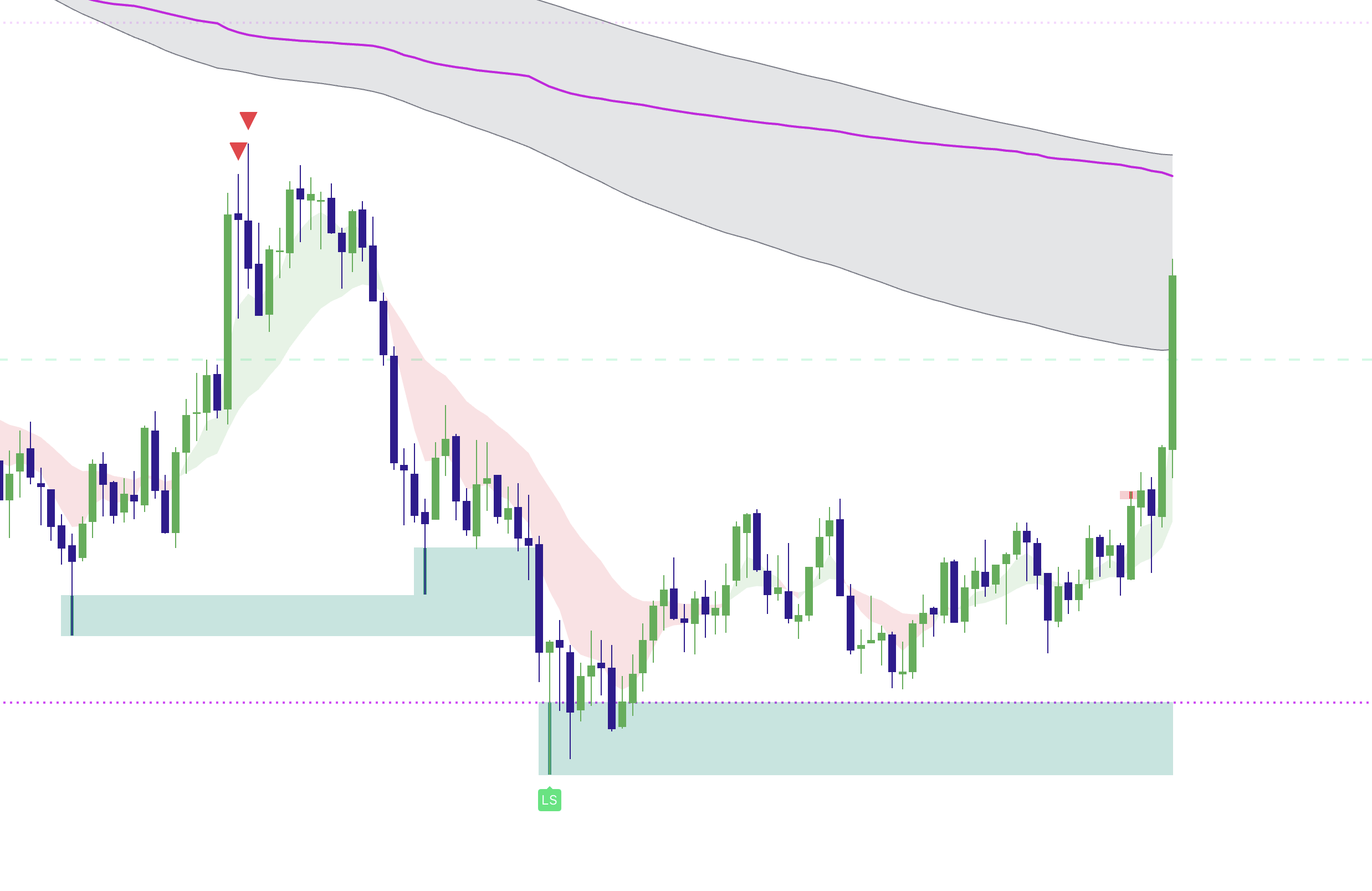

Green Triangle (Buy Signal)

A green triangle under a candle highlights a bullish sweep-and-rejection environment. In practical terms, it suggests:

- Price ran below a prior low where stops are likely clustered

- A rejection wick formed back into structure

- Core momentum/volatility criteria aligned with a reversal thesis

Tradeability Check

Triangle + Level = Signal.

Triangle + No Level = Noise.

Only take triangles that print at a meaningful support level (like a PDL or Session Low).

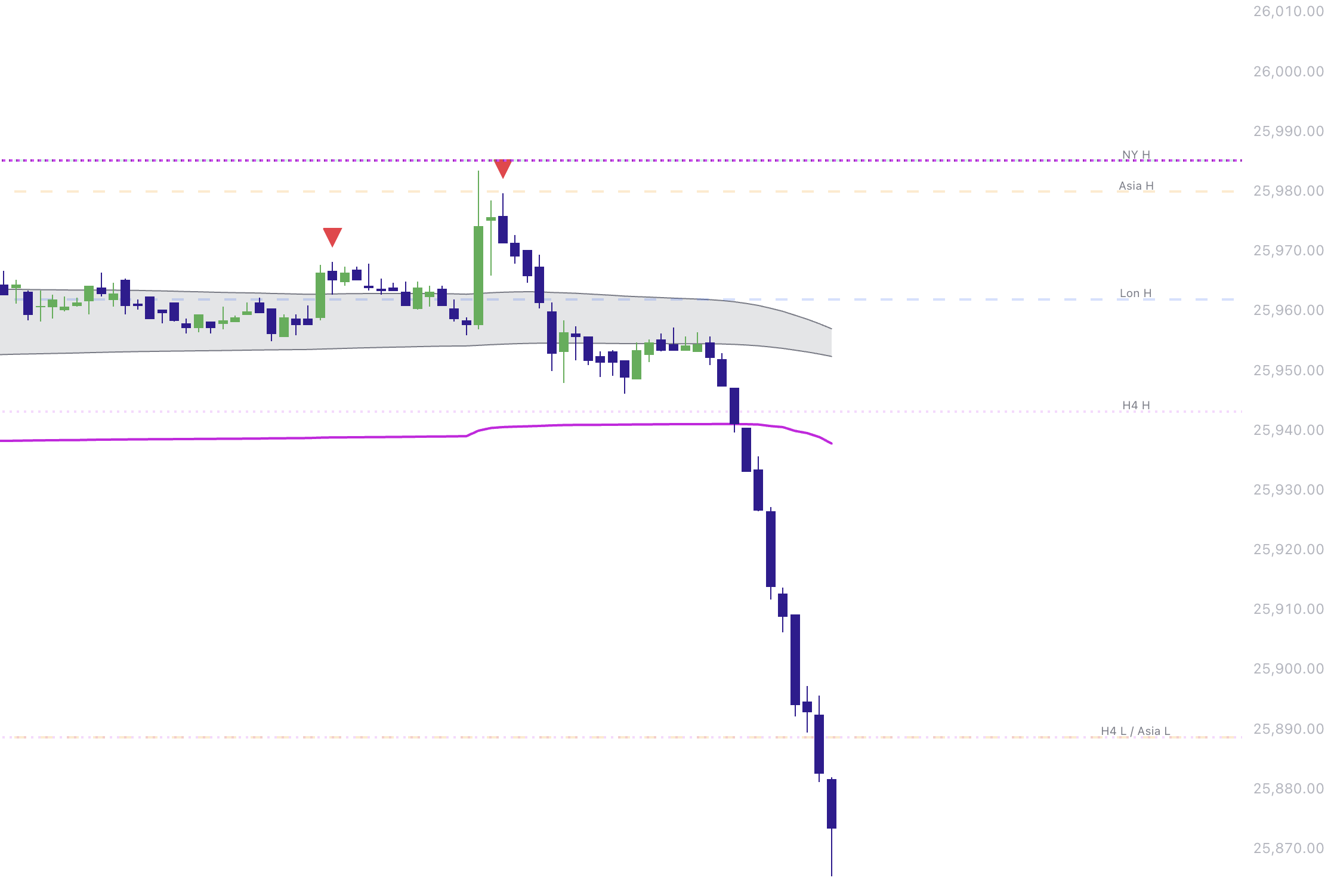

Red Triangle (Sell Signal)

A red triangle above a candle highlights a bearish sweep-and-rejection environment. It commonly indicates:

- Price ran above a prior high where buy stops and breakout orders may be clustered

- A rejection wick formed back into the range/structure

- Core momentum/volatility criteria aligned with a downside reversal thesis

LS Sweep Signals (Sweep Box + Confirmation)

In addition to triangles, you may see small colored LS labels. These represent a more selective sweep confirmation layer:

- Green LS – bullish sweep with premium validation

- Red LS – bearish sweep with premium validation

Which one is better? Think of a Triangle as an "Alert" and an LS Label as a "Confirmed Setup." LS labels require stricter criteria and are often better for beginner sizing.

Liquidity Sweep Boxes

Elev8+ can draw shaded sweep boxes to highlight institutional sweep zones and visually preserve the most relevant rejection areas.

These are excellent for re-tests. If price returns to a Sweep Box and rejects again, it is often a valid re-entry.

- Green Sweep Box – bullish liquidity absorption zone below lows

- Red Sweep Box – bearish liquidity absorption zone above highs

The "Power Hierarchy" of Levels

Not all lines on your chart are equal. Some carry massive institutional weight, while others are minor speed bumps. Prioritize them in this order:

- PDH / PDL (Previous Day High/Low)

- Previous Weekly / Monthly High/Low

- ON H / ON L (Overnight High/Low)

- Asia / London / NY Highs and Lows

- 1H / 15m Pivots

- VWAP

Pro Rule: A sweep of a Tier 1 level is always more significant than a sweep of a Tier 3 level.

Sweep Levels+ Lines (Visual Guide)

Sweep Levels+ automatically plots key liquidity magnets. Here is the decoder for the text labels you will see:

Daily & Overnight (Tier 1 & 2)

- PDH – Previous Day High

- PDL – Previous Day Low

- ON H – Previous Overnight High

- ON L – Previous Overnight Low

Institutional Sessions (Tier 2)

- Asia H / Asia L – Asian session high/low

- Lon H / Lon L – London session high/low

- NY H / NY L – New York session high/low

Weekly/Monthly (Tier 1 - Macro)

- PWH / PWL – Previous Week High/Low

- PMH / PML – Previous Month High/Low

Intraday Structure (Tier 3)

- 1H H / 1H L – One-hour pivot highs/lows

- 15m H / 15m L – Fifteen-minute pivot highs/lows

VWAP and EMA Bands

If enabled in your configuration, Sweep Levels+ may also display:

- VWAP – intraday fair value reference. Use this as a target for your trades or support & resistance in a trend.

- EMA Bands – trend/regime context for filtering counter-trend sweeps and pullbacks.

Highest-Probability Confluence

The strongest Elev8+ reversal environments tend to appear when several components align in the same location:

- Price tags or briefly breaks a Tier 1 Level (PDH/PDL)

- A Triangle or LS label prints with a strong rejection candle

- Rejection wick structure is clean and decisive

Optional suite confluence: Market Map helps confirm the level with better visual session structure, Market Extremes helps confirm you’re near a exhaustion area (not mid-range), and Momentum Gaps helps map the most logical rotation path and pullback areas after confirmation.

Execution reminder

- - Signals are only one layer of the system.

- - Level location and rejection quality determine tradability.

- - Risk should be defined by the sweep invalidation point.

- - Elev8+ Signals don't occur on every timeframe during a sweep. It is best to watch multiple time frames for confluence as shown in the image below (4h/1h/15m/5m/2m/1m).

Conclusion

The Elev8+ ecosystem decodes the language of liquidity: sweeps, absorption, rejection, institutional levels, and structured reversal contexts. Once you internalize this legend—and remember the Level Hierarchy—your chart becomes a clean map of where liquidity is most likely to be harvested and where clean reversals are most likely to form.